| Sun Peaks Market Update |

|---|

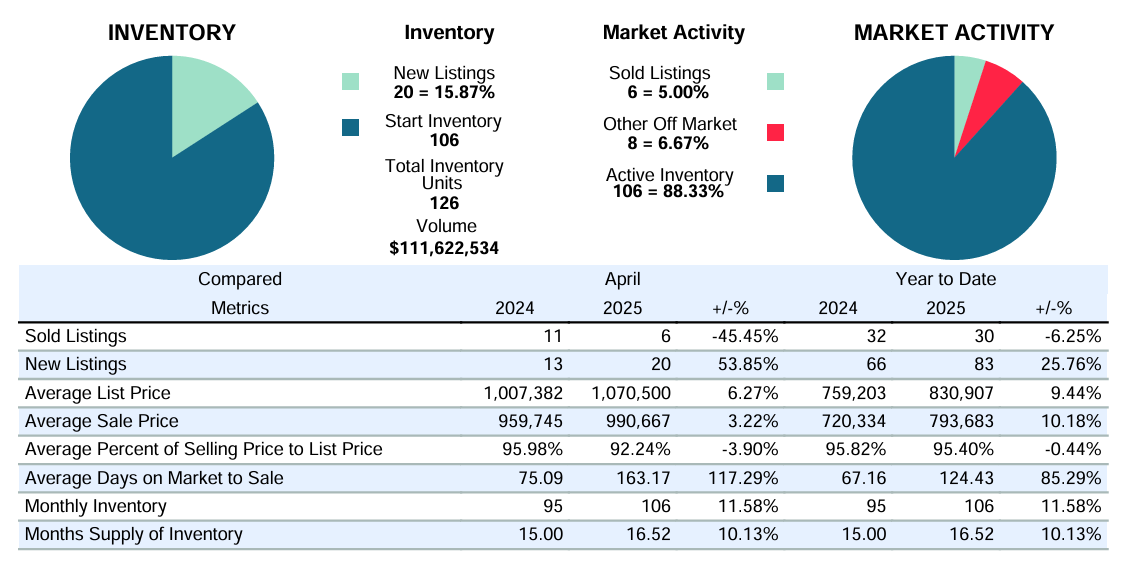

| As we move further into spring, Sun Peaks’ real estate market continues to reflect the broader cooling trend seen across the province, with growing inventory and more selective buyers shaping activity on the ground. Inventory Grows, Buyer Demand Slows April ended with 106 homes for sale, marking an 11.58% increase in active inventory compared to March. With an average of just 6 sales per month over the past year, this brings the Months of Supply (MSI) to 16.52, indicating a strong tilt toward a buyer’s market and intensifying competition among sellers. Longer Time on Market Homes are taking significantly longer to sell, with the average Days on Market (DOM) jumping to 163 days, a 117% increase from this time last year. This suggests buyers are taking their time, evaluating options carefully, and holding out for the right fit or price. Market Momentum: What’s Next for Sun Peaks? Heading into the summer season, rising inventory and longer days on market suggest continued opportunities for buyers, especially those seeking choice and value. Sellers will need to stay competitive with pricing and presentation as conditions shift toward a more balanced market. With average prices trending upward, there’s still confidence in the long-term value of Sun Peaks real estate. Property Pricing Overview (Average Listing Price): Detached Homes: $2,178,350 Townhomes: $1,286,695 1/2 Duplex: $1,252,933 Condos: $796,511 Condo-Hotels: $176,367 Vacant Lots: $605,941 |

**Reports produced and compiled by RE STATS INC. Information is deemed reliable but not guaranteed. Does not reflect all market activity.

| Market Trends: B.C.’s Housing Market & Economic Outlook |

|---|

| Sales Slowdown Continues in April British Columbia’s housing market saw another drop in sales activity this April, with 6,453 residential unit sales recorded—down 14.6% compared to the same month last year. According to the BC Real Estate Association, the overall sales volume in April fell nearly 20%, and activity remains 27% below the 10-year average. BCREA attributes this continued slowdown largely to “uncertainty regarding trade and monetary policy,” especially in higher-priced markets like the Lower Mainland (BCREA). While the market is still subdued by historical standards, improving selection and price adjustments may encourage more activity as we head into the summer. Interest Rates Hold Steady Amid Economic Considerations On April 16, 2025, the Bank of Canada announced it would maintain its key policy rate at 2.75%, citing ongoing economic uncertainty and the impacts of global trade tensions (Bank of Canada). This decision follows a series of rate cuts in 2024 aimed at stimulating the economy, and signals the Bank’s current wait-and-see approach as it assesses inflation trends and economic resilience. Although inflation has eased closer to the Bank’s 2% target, policymakers remain cautious. As highlighted by financial analysts, the Bank’s tone suggests a focus on stability rather than immediate cuts, particularly amid concerns about protectionist U.S. trade policies and their potential effect on growth (MoneySense). The next rate announcement is scheduled for June 4, 2025, and will offer further insight into whether conditions are favorable for future rate reductions. Advocacy for Reassessing Foreign Buyer Restrictions The British Columbia Real Estate Association (BCREA) is advocating for a reevaluation of the current restrictions on foreign homebuyers. Chief Economist Brendon Ogmundson suggests that a targeted strategy to reopen the market to foreign buyers could stimulate housing development and address affordability challenges, especially as pre-sales stagnate and construction slows across the province (Vancouver CityNews). Looking Ahead As we head into the late spring and summer months, B.C.’s real estate market may continue to favour buyers. With elevated inventory levels and moderate price adjustments in some regions, well-prepared buyers could benefit from reduced competition and more negotiating power. While economic uncertainty—particularly around interest rates and global trade—remains a factor, confidence could improve if inflation trends stay on track and borrowing costs ease later in the year. Sellers with realistic expectations and strong presentation will continue to attract motivated buyers, especially in sought-after recreational and lifestyle markets. Whether you’re buying, selling, or just keeping an eye on the market, staying informed will be key in the months ahead. |

| Sun Peaks Resort News |

|---|

| Resort Implements Snow Preservation Initiative In response to climate challenges, Sun Peaks Resort has initiated a snow preservation project by investing in 18 insulated mats designed to retain snow through the warmer months. This $180,000 investment aims to preserve approximately 14,000 cubic metres of snow, which will be stored and later redistributed to enhance early-season skiing conditions. The technology, developed by Finnish company Snow Secure, is expected to retain up to 80% of the snow, even under high summer temperatures (Sun Peaks Resort). Sun Peaks Launches First Municipal Housing Development Sun Peaks is advancing its first municipally-owned rental housing project at 1180 Sun Peaks Road, as part of the BC Builds program. The planned six-story building will offer approximately 110 rental units, ranging from studios to three-bedroom apartments, aimed at supporting the local workforce and residents. The development will be owned and operated by the Sun Peaks Housing Authority, with occupancy restricted to permanent Sun Peaks residents and employees (Sun Peaks Municipality). |