| Sun Peaks Market Update |

|---|

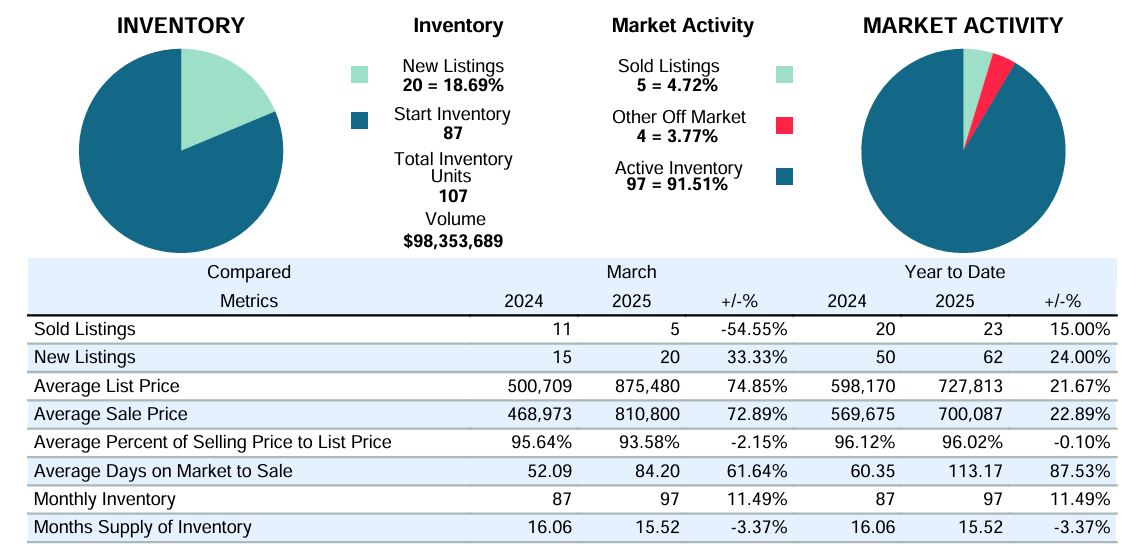

| As we shift into spring, real estate markets across Canada are evolving in response to economic trends, shifting buyer priorities, and increased inventory. At Sun Peaks, we’re seeing similar dynamics play out with notable shifts in pricing, supply, and sales activity. Inventory Rising, Sales Slowing March ended with 97 homes for sale, an 11.49% increase from the previous month. With an average of 6 sales per month over the past year, the Months of Supply (MSI) has risen to 15.52, indicating a growing inventory and a more competitive market for sellers. Average Sale Prices Surge Despite softer sales activity, average sale prices climbed significantly, up 72.89% year-over-year to $810,800. This signals continued demand for premium properties, particularly among high-net-worth buyers who are less sensitive to financing conditions. Days on Market Climb Homes are taking longer to sell, with the average Days on Market (DOM) rising to 84.2 days, a 61.64% increase from last March. This reflects more cautious buyer behavior and emphasizes the need for strategic pricing and strong marketing. Spring Outlook While buyer activity is steady, inventory is growing faster than sales. 20 new listings were added in March, but only 5 sales closed, resulting in a 25% list-to-sale ratio, down from 73.3% a year ago. This gap suggests that sellers must remain flexible and competitive with pricing to attract today’s more discerning buyers. Demographic trends also continue to shape the market. Baby Boomers are listing, while Millennial and Gen Z buyers are focused on energy efficiency, smart home features, and long-term value. Bottom Line With rising inventory and evolving buyer expectations, sellers should be strategic with pricing, while buyers have more options and negotiating power this season. Property Pricing Overview (Average Listing Price): Detached Homes: $2,157,669 Townhomes: $1,352,580 1/2 Duplex: $1,139,950 Condos: $727,907 Condo-Hotels: $192,090 Vacant Lots: $605,941 |

**Reports produced and compiled by RE STATS INC. Information is deemed reliable but not guaranteed. Does not reflect all market activity.

| Market Trends: B.C.’s Housing Market & Economic Outlook |

|---|

| Tariff Uncertainty: A Temporary Cloud Concerns about new U.S. tariffs on Canadian lumber and other goods have sparked headlines, raising worries over potential impacts on home construction and costs. However, some experts suggest these fears may be overstated, noting that the B.C. market has weathered similar disruptions before (Business in Vancouver). The province’s developers are keeping a close eye on trade negotiations, but many believe strong local demand and government housing initiatives will help offset any short-term fallout (Vancouver CityNews). Balanced Market Replacing Pandemic Frenzy After years of aggressive price growth, the market is moving toward more balanced conditions. This isn’t a crash—it’s a normalization. According to NerdWallet, while prices may soften slightly in certain overheated pockets, Canada’s housing market remains fundamentally sound, supported by population growth, immigration, and job stability (NerdWallet). Buyers now have more breathing room, and well-priced homes continue to see interest. Recreational Markets Adjust—but Remain Resilient The vacation home boom sparked by the pandemic has cooled, but prices in B.C.’s mountain and lake communities are holding strong. Limited inventory in sought-after destinations—like Sun Peaks—continues to support property values even as transaction volume dips (Business in Vancouver). With more owners choosing to hold onto their investments long-term, the recreational segment remains a valuable niche. Looking Ahead While some uncertainty remains—particularly around trade negotiations and global economic trends—the fundamentals of B.C.’s housing market remain strong. The upcoming season could offer fresh opportunities for buyers and sellers who are prepared and informed. Whether you’re considering a move, a vacation home, or a long-term investment, the spring and summer months may present the window you’ve been waiting for! |