| Sun Peaks Real Estate Trends & Insights – December Stats |

|---|

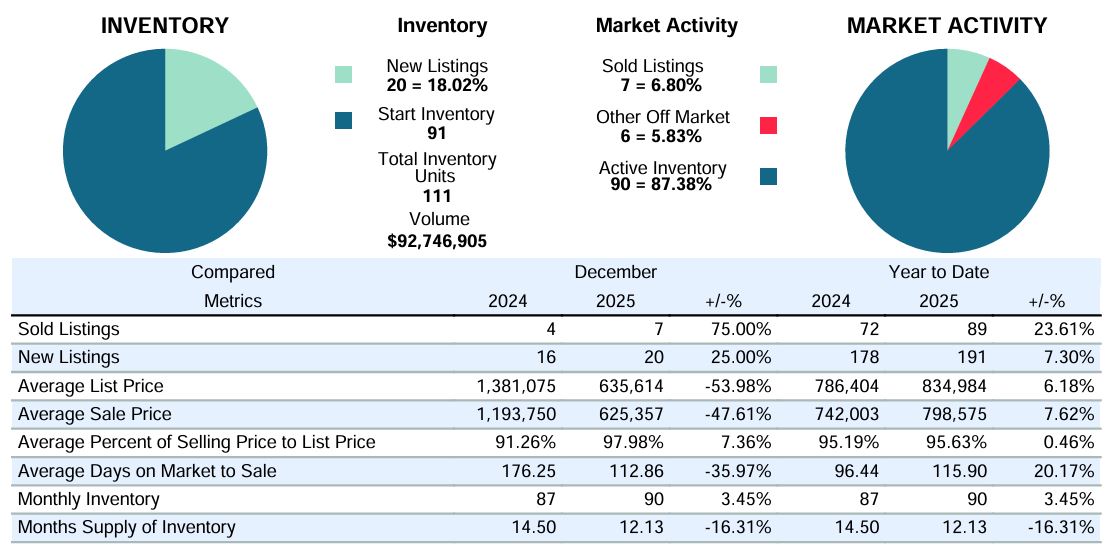

| The new year is off to a bright start at Sun Peaks. While January has brought milder temperatures and mixed snow conditions, the resort has been treated to some beautiful bluebird days that remind us why winter in the mountains is so special. With the village active, events underway, and the season settling into its mid-winter rhythm, it’s a great time to take a look at what’s happening locally. Here’s your January market update with the latest on Sun Peaks real estate and what’s shaping the months ahead. Market Shifts in December Housing inventory in Sun Peaks remained relatively stable in December, with 90 properties available for sale, a modest 3.5% increase from the previous month. With an average of seven sales per month over the past year, the market is sitting at roughly 12.1 months of supply. This keeps conditions relatively balanced as the winter season ramps up, a time that typically brings stronger buyer interest to the village. Prices Moderate After a Strong Year Average sale prices eased in December, coming in at $625,357 compared to $1,193,750 in December 2024. This shift reflects the mix of properties sold rather than a broad market pullback, with activity spread across different price points as buyers focus on value and timing ahead of peak ski season. Faster Turnaround Times Properties that sold in December spent an average of 113 days on market, nearly 64 days faster than the same time last year. Shorter selling times point to motivated buyers and well-priced listings finding traction, even as inventory levels remain healthy. Sales Activity Shows Seasonal Strength New listings increased to 20 in December, up 25% from last year, while seven properties sold compared to four in December 2024. This improved list-to-sold ratio of 35% highlights steady demand, with winter buyers continuing to engage as the resort season gains momentum. Looking Ahead With winter activity in full swing and buyer interest typically strongest during ski season, well-presented and competitively priced properties are well positioned in the months ahead. For sellers, this can be an opportune time to capture motivated lifestyle buyers, while purchasers may still find choice and leverage in a balanced market. Property Pricing Overview (Average Listing Price): Detached Homes: $2,349,667 Townhomes: $1,443,346 Half Duplex: $1,229,900 Condos: $901,421 Condo-Hotels: $175,900 Vacant Lots: $601,281 |

**Reports produced and compiled by RE STATS INC. Information is deemed reliable but not guaranteed. Does not reflect all market activity.

| What’s Happening in Canadian Real Estate |

|---|

| National Sales Cool as Markets Reset Canada’s real estate market wrapped up 2025 with softer sales levels, reflecting ongoing affordability challenges and a more cautious approach from buyers (cbc.ca, crea.ca). While activity slowed overall, analysts describe the shift as part of a broader market reset rather than a downturn, setting the stage for more stable conditions moving into 2026 (canadianmortgagetrends.com). Regional Markets Show Mixed Momentum Across British Columbia, market conditions are diverging by region. Interior markets such as the Okanagan and Thompson-Nicola ended the year on relatively solid footing, with sales activity approaching more typical seasonal levels, though still below long-term norms (castanet.net, businessexaminer.ca). In Kamloops, 2026 property assessments show values largely holding steady, suggesting balanced conditions rather than rapid growth or decline (cfjctoday.com). Pricing Trends Vary Across B.C. Recent assessment updates reveal mixed pricing trends across the province. Many Okanagan properties saw modest downward adjustments, while other areas experienced little change year-over-year (castanet.net). This uneven pricing outlook underscores what analysts are calling a “two-market” dynamic in B.C., where higher-priced urban centres face more pressure while smaller and recreational markets adjust more gradually (biv.com). |